Comparing the UK economy with its pre-pandemic size has become an almost totemic way of highlighting its sluggish performance post-COVID.

It has certainly been a gift for Opposition politicians and in particular when – in September last year – the Office for National Statistics (ONS) produced evidence that the UK was the only economy in the G7 group that remained smaller than it was in February 2020.

However, today brought news that the UK economy actually fared better in the post-COVID period than previously thought.

The ONS unveiled a series of revisions for past GDP growth – affecting both 2020 and 2021.

It said that the UK economy contracted by 10.4% in the main pandemic year of 2020 – less worse than the 11% contraction previously reported.

And it said UK GDP grew by 8.7% in 2021 – considerably better than the previously reported growth of 7.6%.

Put together, it means that at the end of 2021 – rather than being 1.2% smaller than it was going into the pandemic as previously reported – the UK economy was actually 0.6% bigger.

Some will say that this is all just rear-view mirror stuff and does not really matter.

But it does.

Even in its most recent estimates for quarterly growth, the ONS was suggesting that, during the three months to the end of June, the UK economy remained 0.2% smaller than it was during the final three months of 2019, the last full quarter before the pandemic struck.

Carry these revisions across to the latest data though, and it means that, rather than being at the bottom of the G7, the UK’s economic recovery post-pandemic was well ahead of Germany and not far behind those achieved by France and Italy.

The Treasury was also quick to point out that, as of the end of 2021, the UK’s recovery trailed only those of the US and Canada in the G7.

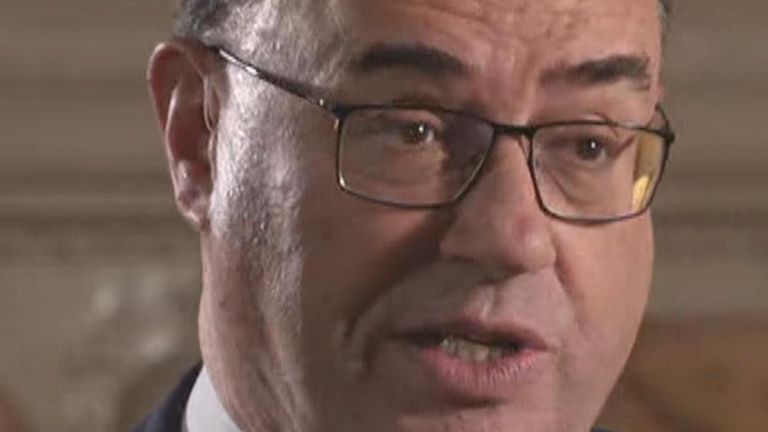

Chancellor Jeremy Hunt said: “The fact that the UK recovered from the pandemic much faster than thought shows that once again those determined to talk down the British economy have been proved wrong.

“There are many battles still to win, most of all against inflation so we can ease cost of living pressures on families. But if we stick to the plan we can look forward to healthy growth which according to the IMF will be faster than Germany, France, and Italy in the long term.”

The ONS explained the rather dramatic upward revision thus: “These revisions are mainly because we have richer data from our annual surveys and administrative data, we are now able to measure costs incurred by businesses (intermediate consumption) directly and we can adjust for prices (deflation) at a far more detailed level.”

Part of the revision can be explained by the fact that the ONS now has a more detailed understanding of how much people were being paid in the 2021-22 financial year following the availability of more up-to-date information from HM Revenue & Customs. More up-to-date information on household spending during 2021, for example on telecoms services, has also been incorporated into the assessment of GDP.

Put together, these led to some pretty dramatic upgrades in parts of the services sector, which makes up four-fifths of UK GDP. The ONS now thinks the services sector as a whole grew by 10.9% in 2021, way ahead of the previous estimate of 7%, which is a pretty extraordinary upward revision.

The biggest contributors to that, according to the ONS, was from the wholesale and retail trade, and repairs to cars and motorcycles in particular.

Another contributor was accommodation and food services, which is now reckoned to have grown by 31.3% in 2021, up from the previous estimate of 30.9%.

Clearly the rush among Britons to eat out and stay in hotels after lockdowns ended was even bigger than previously thought.

Other sectors where activity was stronger than previously assumed were professional scientific and technical activities and healthcare services.

The commercial property sector, previously thought to have contracted during the year in question, is also now reckoned to have enjoyed growth.

These revisions are really important in terms of how we view the UK’s economic performance.

As Simon French, the chief economist and head of research at the investment bank Panmure Gordon was quick to note, the entire UK economic narrative, post-pandemic, has just been revised away. All those headlines about the UK economy not being back at pre-COVID levels, or bottom of the G7, are now obsolete.

He added: “But as a macro guy who has had to talk to international investors [about] why gilts and UK equities do or do not deserve [to trade at] a discount, this has cast huge doubt on recent investor conclusions.

“I may be biased but this deserves to lead every UK economic and business story today – to provide symmetry to the coverage that the sluggish post-pandemic recovery that has shaped investor/business/household sentiment.”

That is a key point.

There has been much hand-wringing in recent months about why international investors are shunning UK assets and why some UK companies have sought to switch their main stock market listing from London to New York.

Much of that negativity will have been informed by headlines about the UK’s lacklustre growth post-pandemic.

There is a word of caution, though. One is that the national statisticians of other countries are embarking on similar revisions to their GDP statistics using something called the “SUTS” – supply and use tables – framework. This approach is reckoned to provide a more accurate assessment of how a particular industry or sector has performed and, by extension, the economy as a whole. The statistics offices of the UK and the US are, at present, the only ones to have done this.

As the ONS pointed out today: “This means that the UK has one of the most up-to-date sets of estimates for this period of considerable economic change. Other countries follow different revision policies and practices, which can result in their estimates being revised at a later date.

“It is important this is considered when comparing the UK with other countries and our international comparison position is likely to change once other countries fully confront their datasets over time.”

And there is a broader point to make, too, which is that it is debatable whether GDP is that meaningful a measure, these days, of how the economy is doing and how all of us, as individuals, are living their lives.

As Savvas Savouri, economist at the hedge fund manager Toscafund and one of the Square Mile’s smartest economists, has told clients in the recent past: “GDP is a nonsensical measure of the modern UK economy … it fails to do justice to the ever-growing service-side of the UK economy.

“After all, measuring the production of textiles is very much easier to do than capturing the volume and value of coding for gaming, e-commerce and e-finance, architectural design, writing of legal contracts, insurance underwriting, academia to students from overseas and so forth.”

The ONS would doubtless argue, in response, that this is why it is seeking to finesse its methodology.

And, for now, it is helping paint a more encouraging picture of the UK economy.