Rivian (RIVN) released its second-quarter earnings after the market closed on Tuesday as the EV maker aggressively cuts costs. CEO RJ Scaringe called the quarter a “defining one” as Rivian eyes its first gross profit by the end of the year. Here’s a breakdown of Rivian’s Q2 2024 earnings.

Rivian second quarter earnings preview

After delivering 13,790 vehicles in Q2, up slightly from the first three months of 2024, Rivian expects output to ramp up in the second half of the year.

Due to a planned shutdown at its Normal, IL factory in April, Rivian’s production slipped from over 17,500 in Q4 2023 to 13,980 in Q1, with just 9,612 built in the second quarter of 2024.

Rivian has introduced drastic cost savings measures, including manufacturing upgrades and supplier contracts. Over 100 steps from the battery-making process, 50 components from the body shop, and 500 parts from design have been eliminated.

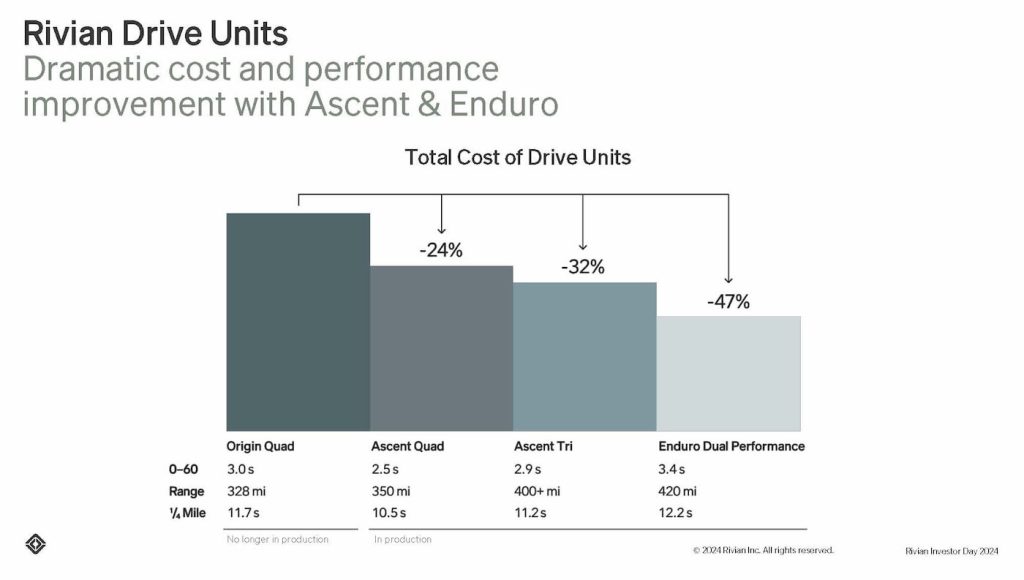

With its new in-house drive units, Rivian cuts 47% of the costs compared to its Origin Quad motor. Rivian expects the trend to continue as new tech rolls out.

We posted an earnings preview yesterday on what to expect from Rivian’s Q2 report. Rivian lost another $1.4 billion in Q1 but expects to achieve its first positive gross profit by the end of the year.

According to Estimize, Rivian is expected to report a loss of $1.17 per share on revenue of $1.18 billion in Q2. Wall Street expects slightly less, with a loss of $1.24 per share on revenue of $1.15 billion.

Rivian Q2 2024 earnings breakdown

Rivian made “significant progress driving greater cost efficiency, improving its products, further strengthening its balance sheet, validating the differentiated nature of its technology stack, and establishing new business opportunities” in Q2.

CEO RJ Scaringe said the second quarter was a “defining one for Rivian.” Rivian reported revenue of $1.158 billion, meeting Wall St expectations.

Rivian’s gross loss increased slightly year-over-year to $451 million compared to $412 million in Q2 2023.

- Rivian Q2 2024 revenue: $1.158 billion vs $1.15 billion expected

- Rivian Q2 2024 EPS: (-$1.13) vs (-$1.15) expected

The EV maker said lower selling prices and less efficiency due to the plant shutdown led to higher losses. As a result, Rivian posted a net loss of $1.46 billion, about flat from the $1.48 billion Q1 loss.

Rivian lost $32,705 on every vehicle built in Q2, an improvement from the $38,784 loss in Q1 but still higher than the $30,500 loss in Q3 2023.

Rivian ended Q2 with $7.87 billion in cash and equivalents. Including its revolving credit facility, Rivian had $9.18 billion in liquidity.

The balance includes $1 billion from Volkswagen as part of its recent partnership. Rivian signed a deal with Volkswagen in June to use its software expertise to create a next-gen EV architecture. Volkswagen will invest up to $5 billion, $3 billion of which will go to Rivian and $2 billion to the joint venture. However, the investments are based on hitting certain milestones.

| Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | Q4 ’23 | Q1 ’24 | Q2 ’24 | |

| Rivian loss per vehicle | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 |

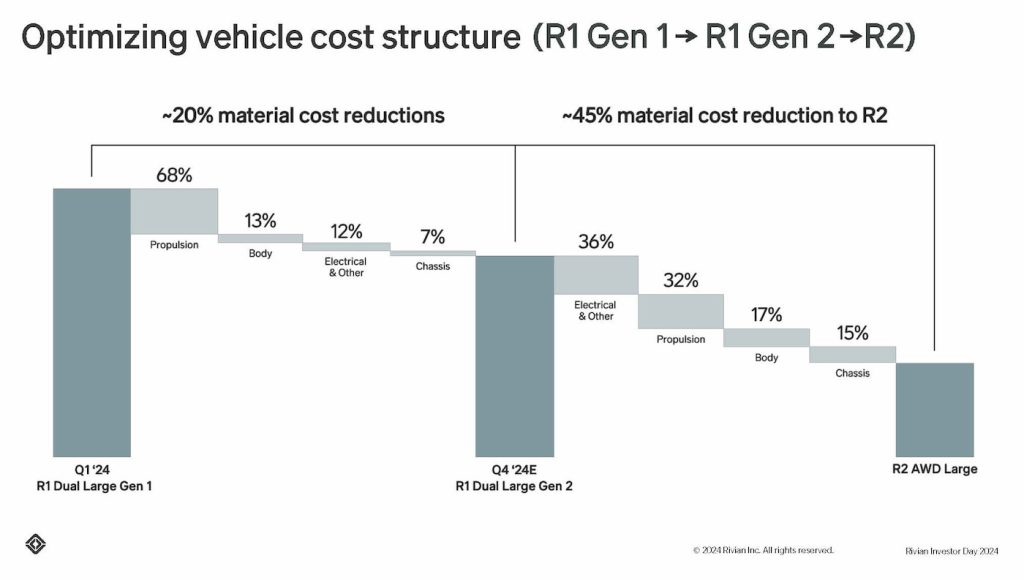

After launching its second-gen R1 models earlier this summer, Rivian expects a 20% material cost reduction compared to the first generation.

Following the upgrades, Rivian expects its R1 production line rate to be 30% more efficient, which should help ramp up output into the end of 2024.

Looking ahead

Rivian is confident it will achieve a positive gross profit in Q4 2024. The company is starting to see impacts from upgrades at its Normal, IL plant and expects to see more results in the second half of the year.

The company reaffirmed that it’s on track to build 57,000 vehicles this year and earn $2.7 billion in adjusted EBITDA.

Looking further out, Rivian expects the momentum to accelerate with the lower-cost R2 launching in early 2026. Starting at $45,000, Rivian’s R2 is expected to open up a massive market.

According to Rivian’s Vice President of Manufacturing Tim Fallon, the R2 has “well over 100,000” pre-orders and continues to climb.

Scaringe recently explained that R2 is “worlds different” than the Tesla Model Y, the benchmark in the EV industry.

When R2 production begins in early 2026, Rivian expects plant output to reach 215,000 units annually, up from around 150,000. The R2 will account for about 155,000, with the R1S and R1T at about 85,000.

Check back for more info following Rivian’s earnings call with investors at 5 pm ET. We’ll keep you updated on the latest below.