The prospect of a pre-election interest rate cut by the Bank of England has been damaged by official figures showing no progress in bringing down the pace of wage growth.

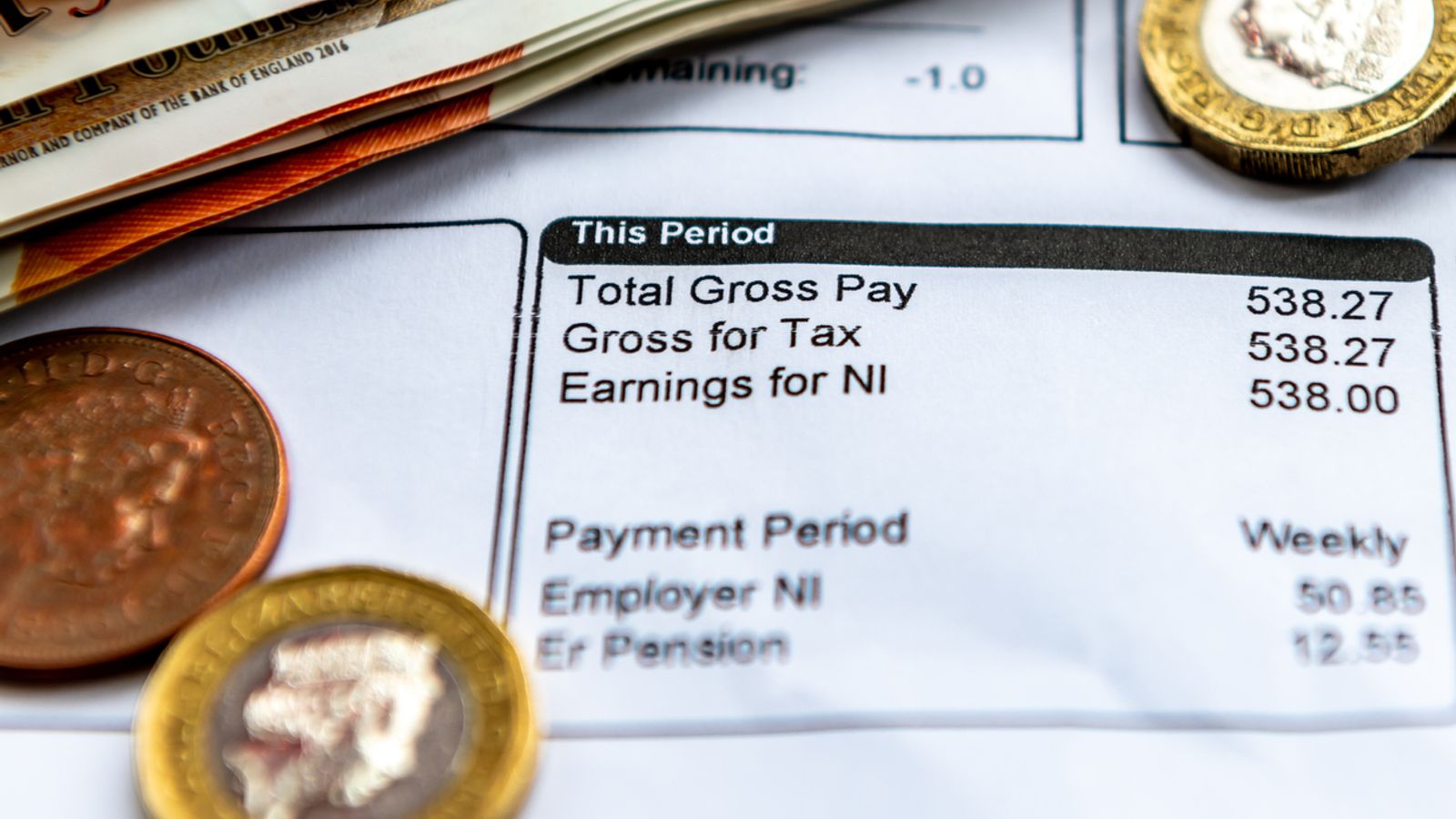

Data from the Office for National Statistics (ONS) showed basic pay rising at an annual rate of 6% in the three months to April.

That was flat on the figure reported by the ONS for the past two months. Upwards pressure came from the government’s 9.8% rise in the National Living Wage, which took effect in April.

Money latest:

Meet the woman behind the UK’s first net-zero whisky distillery

When the impact of inflation was taken into account, the wage rate stood at its highest level since July 2021 at 2.9%.

The pay measure that includes bonuses actually rose to 5.9% from 5.7%, according to the ONS

While it is good news for voters as it leaves pay growth at way more than double the 2.3% inflation rate, it will not help persuade the Bank of England that the time is right for an interest rate cut when it reveals its latest decision on 20 June.

Rishi Sunak would be keen for the Bank, which is independent of the government, to impose a cut to borrowing costs on that date to bolster his case that the outlook for household and consumer finances is improving.

With the Conservatives far behind Labour in the polls, the employment figures from the ONS are the last before polling day on 4 July.

The data also showed a rise in the unemployment rate to 4.4% from 4.3%, though this figure comes with a big health warning from the ONS due to continuing reliability issues with its labour force survey.

What this all means for the Bank

The jobless rate figure may have some influence in Threadneedle St as it signals further damage to the economy from higher interest rates.

The Bank has hinted that an interest rate cut is likely in the coming months but it remains worried about sticky services inflation and the pace of wage growth fuelling more price rises in the economy.

Salary increases have outpaced the rate of inflation since last August, boosting consumer spending power on the face of it, but household budgets have remained squeezed.

The cost of living crisis, exacerbated by unprecedented raw energy price hikes following Russia’s invasion of Ukraine, has evolved over time to even extend to the Bank’s medicine to supress inflation.

There were 14 consecutive interest rate increases from December 2021 up until last summer aimed at dampening demand to help bring price growth down.

The rate hikes drove up the cost of borrowing, with mortgage holders for example facing additional bills of hundreds of pounds more per month on average as low fixed rate terms expired.

New deals proved eyewatering in comparison.

With the main consumer prices index measure of inflation running at 2.3% – above the Bank’s 2% target – members of the rate-setting committee have acknowledged progress but they are unlikely to follow the European Central Bank in cutting rates this month.

Financial markets saw just a 10% chance of a rate cut from 5.25% to 5% on 20 June before the ONS data was published.

Most of the money is on September.

However, those predictions could yet shift.

The ONS is also set to release this week the preliminary growth figures for the economy in April. They are predicted by economists to show zero growth for the month, largely due to the impact of poor weather.

The following week sees the publication of the latest inflation figures.

This breaking news story is being updated and more details will be published shortly.

Please refresh the page for the fullest version.

You can receive Breaking News alerts on a smartphone or tablet via the Sky News App. You can also follow @SkyNews on X or subscribe to our YouTube channel to keep up with the latest news.